The Revenue Commissioners have introduced a VAT Compensation Scheme for Charities, to reduce the VAT burden and to partially compensate charities for VAT incurred in the day-to-day running of the charitable activities. To be eligible for the scheme the charity must: 1. Hold a charitable tax exemption from the Revenue Commissioners (CHY number), and 2. Be registered with the Charities Regulatory Authority (CRA).

Calculate VAT Repayment

VAT reclaims made under the scheme can be submitted through Revenue Online Services (ROS) on an annual basis, before 30th June of the preceding year. For example, a VAT reclaim for 1st January – 31st December 2018 should be made before 30th June 2019.

The amount of VAT compensated is determined by the following formula:

A x B/C

A = Total VAT paid on qualifying expenditure B = Total qualifying income C = Total income

Please note the following; - Qualifying expenditure includes expenses incurred solely for the charitable purpose. - Qualifying income is the total income excluding publicly funded income (such as Government grants, EU grants etc.). Revenue has advised that the minimum VAT reclaim amount is €500 and claims for less than this amount will not be accepted.

The Scheme’s Annual Cap

The Revenue Commissioners have also advised that there is a €5 million cap on the scheme, which is to be reviewed after the first three years, this cap may result in the VAT repayment to charities being lower than the calculated amount.

Other Considerations for Charities Availing of the Scheme

Charities should be aware that in order to receive the VAT refund they are obliged to: - Keep evidence of their invoices/receipts for a period of 6 years. - Have tax clearance issued by the Revenue Commissioners. - Provide the Revenue Commissioners with the most recent set of audited Financial Statements, if requested. Finally, it is important to note that the scheme works on the cash receipts basis, i.e. you can only make a reclaim for costs that have been paid (not just invoiced expenses).

Example

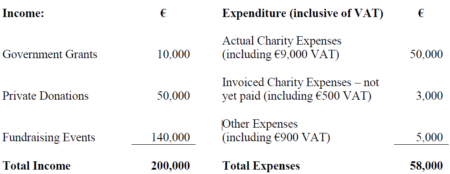

A charity has the following sources of income and expenditure for the year ended 31st December 2018:

The charity would be entitled to a VAT reclaim under the new scheme as follows: A x B/C A = €9,000 (i.e. the VAT on the expenses incurred for the charitable purpose only) B = €190,000 (i.e. total income less government grants) C = €200,000 (i.e. total income including government grants) €9,000 x €190,000/€200,000 = €8,550 The charity is entitled to make a VAT reclaim under the scheme for €8,550. This claim must be made by 30th June 2019. If you’d like to know more on how this scheme can work for your charity, please do not hesitate to contact us and one of our tax experts will be happy to help!