In order to address rising levels of inflation across the EU, along with the increasing regulatory and administrative burden on companies, The EU has implemented the European Union (Adjustments of Size Criteria for Certain Companies and Groups) Regulations 2024, requiring all member states to increase the thresholds for company sizes by circa 25%. On 19th June 2024 these regulations were signed into Irish Law and take effect from 1st July 2024.

These new regulations can be accessed here.

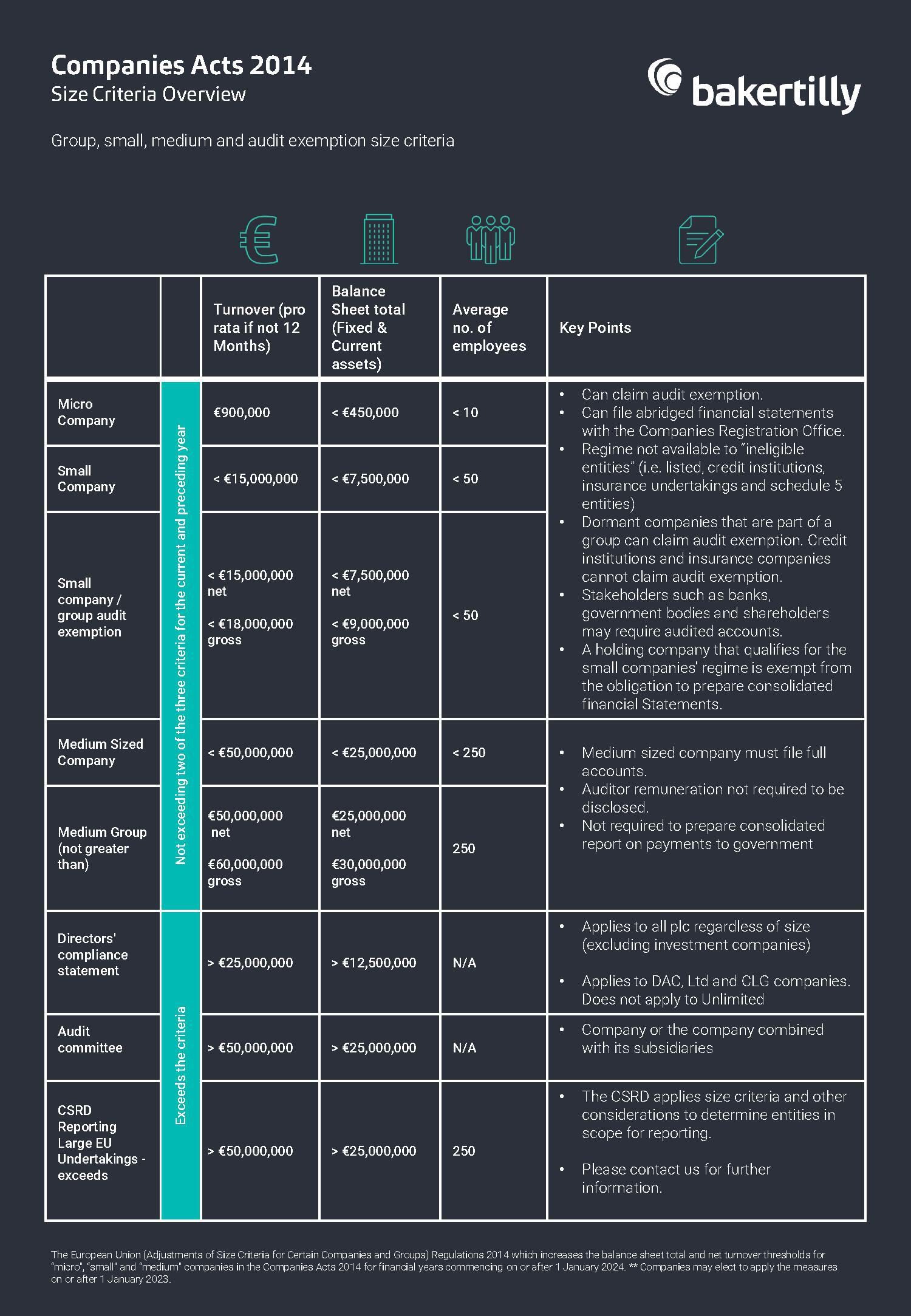

The changes brought about by the regulations widen the scope for companies to benefit from certain exemptions. These include audit exemption and the option to submit abridged financial statements to the Companies Registration Office (CRO) under the micro and small companies’ regime.

These changes will allow a greater number of companies to classify themselves as micro and small, which allows them to enjoy the advantages of simpler and less onerous accounting requirements and fewer disclosure obligations.

In light of these changes, it is also possible that some companies currently classified as ‘medium-sized’ may now qualify as small companies, which will make them eligible for the aforementioned accounting and CRO filing exemptions. These modifications will apply to financial years starting on or after 1st January 2024, and can be availed of immediately. Companies can also elect to apply these regulations to financial periods commencing 1 January 2023 so an element of retrospective relief. Thus, a review of 2023 financial periods where audits have not commenced can be considered where appropriate.

These changes also result in a number of companies falling outside the scope of the impending corporate sustainability reporting under the Corporate Sustainability Reporting Directive (“CSRD”) during the initial phasing in period. The transposition of the CSRD Regulations is expected to be published during summer 2024.

In the second year of phasing-in the CSRD, EU “large” companies will fall into scope for CSRD reporting and be required to report in 2026 on their 2025 results. Some companies currently classified as large companies may now qualify under the new size criteria as medium companies and therefore may fall outside of the scope of CSRD reporting certainly in the initial phasing-in period. A company has to fall outside the criteria for at least two consecutive financial years to fall outside the scope of CSRD Reporting.

If you have any questions in relation to the new adjustments and thresholds, please get in touch with Brendan Kean and Eilish Haughton.